Vendors You Can Count On

Vendors You Can Count On

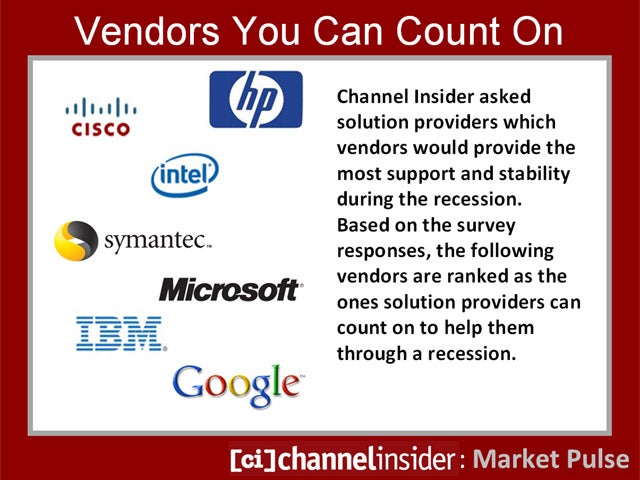

Channel Insider asked solution providers which vendors would provide the most support and stability during the recession. Based on the survey responses, the following vendors are ranked as the ones solution providers can count on to help them through a recession.

10. Oracle

10. Oracle

Changing channel leadership in the past year hasn’t dampened solution providers’ faith that Oracle will be there for them in a recession. Oracle CEO Larry Ellison has indicated that the software vendor will use the suppressed valuations to go on an acquisition spree, which could mean new products and opportunities for solution providers.

9. Symantec

9. Symantec

Big Yellow is doing a fantastic job of recovering from the missteps of the past few years, providing better support to its partners, correcting shortcomings with its partner systems and fielding better products. Solution providers seem to think the good times will keep on rolling.

8. VMware

8. VMware

In the Market Pulse survey, virtualization software is the deemed the second most exciting technology for 2009. VMware leads the virtualization market, and solution providers believe the vendor will continue to support them through the recession and the looming battle with Microsoft.

7. Google

7. Google

While Google has sold through the channel for several years, it hasn’t committed itself to supporting its partners until the recent launch of a channel program for Google Apps. Even as assaults on the search giant seem to be intensifying, Google remains the game to beat. If there’s any company that’s going to weather the recession, it’s Google.

6. Dell

6. Dell

It’s been little more than a year since Dell formally entered the channel. While many solution providers still harbor fears that the formerly direct-only vendor will turn on its channel, Dell has added more than 25,000 solution providers to its channel program, and Dell’s channel revenue is one of the few bright spots on its accounting ledger.

5. IBM

5. IBM

Big Blue continues to invest in new markets, technologies and channels. One of the founding members of the channel, IBM is consistent in its support and dedication to fostering growth among its business partners. Most recently, IBM extended credit offerings to solution providers, providing a reliable source of financing new business.

4. Intel

4. Intel

Don’t expect momentary blips in its quarterly revenues to hold down Intel or force it to turn on its channel. Intel is one of the most channel-centric vendors and is known for supporting its OEM and reseller partners. Expect Intel to continue its investments in growing channels, despite tough times.

3. Cisco

3. Cisco

Cisco continues to dominate the networking market with its switches and routers, and does so with an army of solution providers and resellers working on its behalf. Its Emerging Markets groups is cultivating new channels and partners in new technologies—telepresence, physical security and video communications.

2. HP

2. HP

Under CEO Mark Hurd, HP has skyrocketed its revenue and profits, mostly through its channels and successful AttachOne program. HP is pouring resources into its ProCurve networking line, providing partners with a Cisco alternative. And it continues to lead in the PC market. That, and a solid channel program, is a recipe solution providers can count on.

1. Microsoft

1. Microsoft

Microsoft, the 800-pound gorilla of the channel, continues to instill the trust and confidence of solution providers. While the general marketplace questions some of Microsoft’s technology and strategic choices, and solution providers continue to dissect its SAAS offerings, solution providers continue to lead with the support provided by Microsoft’s standard-setting channel program.