In the technology sector, 2009 started in a panic. IT budgets were frozen. End users were extending the service live of their installed hardware. Tech professionals were being laid off by the thousands. And the big tech vendors were watching their stock prices go into freefall. By all indications this time last year, 2009 was going to be brutal.

That was then, this is now. By Wall Street measures, the IT sector ended 2009 in better shape than many of the other major industries of the economy, with stock prices of most leading tech vendors and distributors closing the year with double-digit – or better – gains.

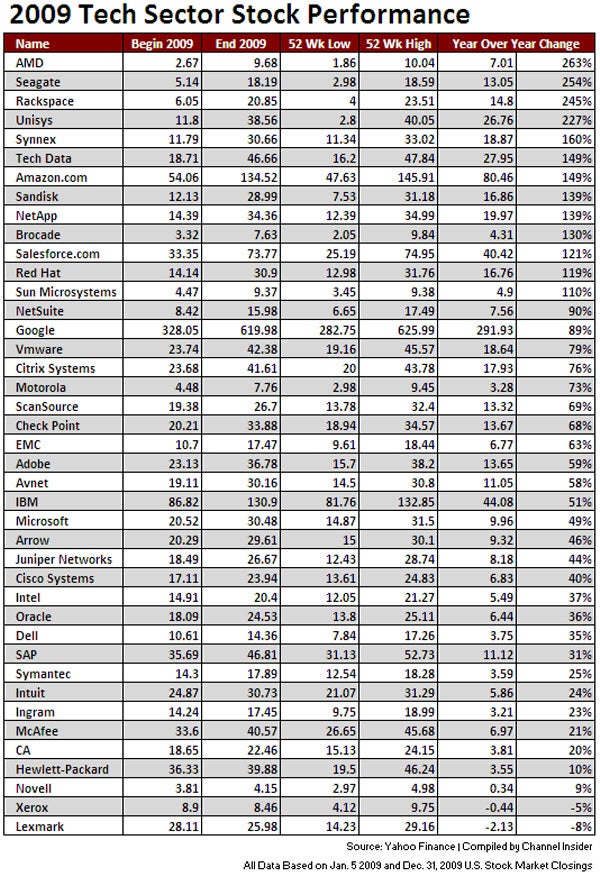

Channel Insider reviewed the 2009 stock performance of 41 technology vendors and distributors traded on U.S. indexes. Thirteen companies had triple-digit gains and 25 had double-digit stock increases. Only one vendor, Novell, had a single-digit stock price increase (9 percent). And only two vendors saw their stock prices decrease. (See chart below for complete details.)

The impressive year-end stock performance is no fluke of investors driving up prices to capitalize on short-term gains. Nearly all of the companies evaluated finished 2009 off their 52-week high.

Cloud computing vendors and providers showed some of the strongest gains as businesses on every level continue to migrate IT applications and infrastructure to Web-based delivery systems. Rackspace, a provider of hosting and cloud computing services, was the third biggest winner on the list with a stock price increase of 245 percent. Amazon.com, operator of Amazon Web Services and the Elastic Cloud Computing platform, saw its stock increase 149 percent, but some of that gain can be attributed to the increases in online consumer retail sales. NetSuite, the cloud-based ERP provider, recorded a 90 percent year-over-year gain. Google regained much of its Wall Street strength by logging an 89 percent 2009 gain.

Surprisingly, hardware vendors and components had a strong showing in the top stock performers of 2009. AMD posted the most significant 2009 gain – 263 percent. Seagate, Sandisk, NetApp, Brocade and Sun Microsystems each posted triple-digit stock increases for the year.

Although they’re heavily reliant on the sales of hardware and software products, distributors outperformed the market in 2009. Synnex and Tech Data posted gains of 160 percent and 149 percent, respectively. Specialty distributor ScanSource closed the year with a 69 percent uptick. And Avnet, Arrow and Ingram Micro boasted solid increases.

Only two vendors, Xerox and Lexmark, saw their stock prices decrease as demands for printers and consumables slipped in 2009.