Given the precipitous drop in net-new server sales during this recession, Cisco’s launch into the entry-level rack mount space this week seems somewhat counterintuitive. Especially at the commodity level, a market segment that doesn’t offer much margin and is already saturated with volume-based products from Hewlett-Packard, Dell and IBM. Indeed, IBM has begun moving away from the entry-level space in search of better profitability from higher-end platforms that offer the opportunity to charge more for specialized features.

So what is fueling Cisco’s confidence in its new C-Series entry-level server when the other vendors are losing share and revenue?

Q1 SERVER SALES SLIDE: Click here to see the market data

The company is touting the C-Series as an opportunity for solution providers to ease budget-strapped customers into a foundation layer for its broader Unified Computing System (UCS) set of converged data center products and technologies. They are counting on the lure of future add-on sales of high-margin UCS technologies to entice partners to push the C-Series into customer shops now over commodity servers from other vendors they currently have in their portfolios.

“Really what [Cisco] wants to do is have a full portfolio,” says IDC’s Cindy Borovick, of Cisco’s entry-level server play. “If a customer invests in Unified Computing system, they want to make sure they have a platform that will meet all their needs, not just at the high end.”

Borovick further points out that the low-end servers provide customers with a way to try out the platform. And she expects Cisco to be aggressive in terms of getting evaluation systems out into the market and into the hands of customers.

Cisco described the C-Series as investment protection for customers who eventually want to take advantage of the higher-end UCS architecture features, including expanded memory, a virtualization adapter and hypervisor bypass. The company is banking that the memory capabilities are where the servers will stand out from other servers on the market. While analysts agreed memory is a differentiator there’s plenty of time for the other vendors to play catch up even before the C-Series ships.

“Cisco will see competition here,” Borovick said. “Competitors will be able to respond to this in fairly short order.”

The lone variable in this server battle could be pricing. Cisco does not plan to release pricing until the C-Series ships, but short of significant technology differentiators, low price might be the only way they can hope to break into the market and steal share.

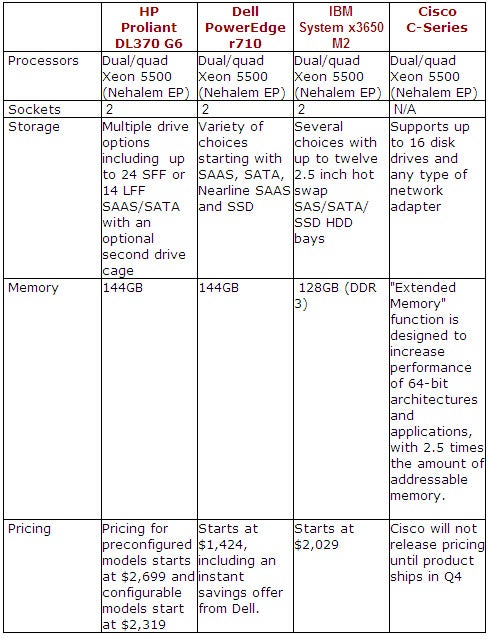

A Comparative Look at Entry-Level Servers