SolarWinds report shows why IT leaders need to take action on processes and prioritize people improvements over new tools to address resilience gaps.

Apono launches a global partner program to deliver scalable, identity-aware access controls with GTM support, training, and cloud ecosystem access.

CGS restructures into four independent companies to sharpen focus, drive growth, and better serve global markets across tech, learning, and CX.

A fast-paced editorial recap of Q2 2025 in the IT channel covering leadership shakeups at Kaseya, layoffs at Intel, federal obstacles pausing major acquisitions, AI adoption slowdowns, quantum security threats, evolving partner programs, and global economic tensions.

CloudBolt partners with Ingram Micro, enabling MSPs and VARs to scale advanced cloud management and FinOps automation across environments.

Infor signs strategic AWS agreement to boost AI adoption, deepen cloud ERP capabilities, and accelerate global digital transformation.

Malwarebytes adds AI-powered email protection to ThreatDown, unifying endpoint and email security for MSPs via IRONSCALES tech and Nebula console.

Galactic Advisors uncovered critical flaws in Kaseya’s Network Detective; both firms moved fast to patch issues and highlight MSP risk assessment best practices.

Cynomi report shows vCISO demand tripled as MSPs turn to AI for scalable cybersecurity. 96% now offer or plan to offer vCISO in the next two years.

Barracuda study: Businesses rely on MSPs for security needs, with most willing to pay more for premium AI, integration, and 24/7 support.

CISA funding cuts risk NVD stability — MSPs must adapt VM to better support customers and strengthen security resilience.

SentinelOne and OPSWAT partner to boost AI-powered malware detection for critical infrastructure protection on-prem and in the cloud.

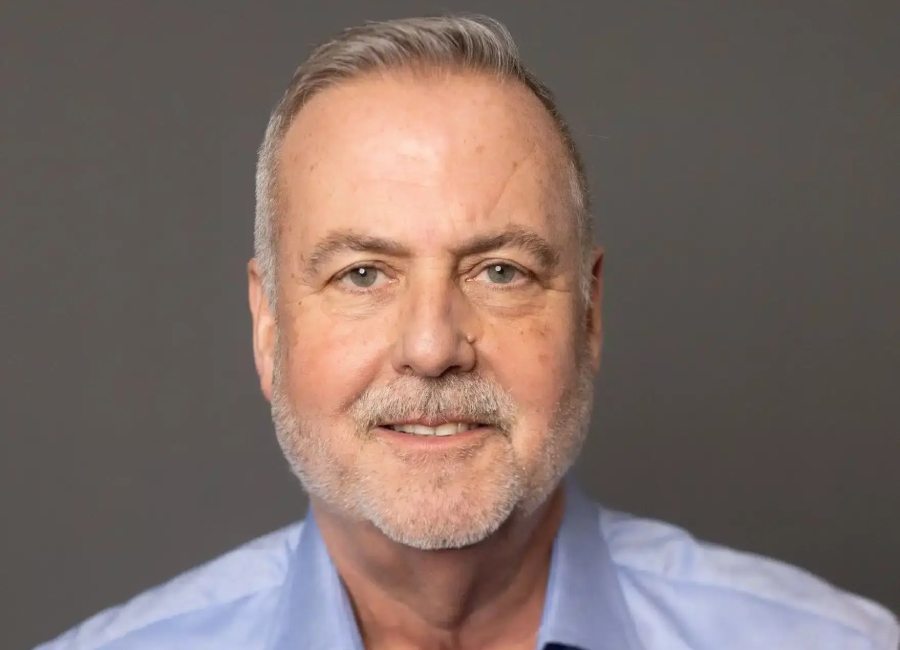

Channel Insider is thrilled to recognize the following leaders in vendor and solution provider businesses for their work in enabling the next generation of technology adoption. This list was compiled by Channel Insider’s editorial team to spotlight channel-focused leaders from MSPs, MSSPs, VARs, GSIs, vendors, and other channel businesses who are delivering measurable AI-driven outcomes […]

The expanded alliance emphasizes AI-driven defenses, sovereign cloud capabilities, and new anti-scam protections for businesses worldwide.

Arctera updates Insight to help organizations capture, chronicle & contain AI data, easing compliance and unlocking insights from LLM interactions.

Discover how Port’s AI-native developer portal is helping engineering teams streamline workflows, reduce DevOps bottlenecks, and build scalable software faster.

New File IQ Premium and Ops IQ tools aim to help enterprises uncover file activity, system trends, and AI-ready insights across unstructured data

LevelBlue and Kompingo partner to deliver scalable managed security to UK MSPs and MSSPs, bridging the cyber skills gap with expert threat protection.

GTT survey shows rising private cloud demand driven by security, compliance, and AI needs, offering partners new opportunities to guide migration.

Nerdio’s MSPs navigate device refreshes, tariffs, and virtualization, advising clients through uncertainty with Azure Virtual Desktop and Windows 365.

DartPoints, a provider of secure, high-performance data center solutions for enterprises, recently announced a significant investment from NOVA Infrastructure, a middle-market infrastructure investment firm, to scale DartPoints’ platform. Investment from NOVA and OIC pushes data center solutions forward “We’re entering a new phase of growth centered on infrastructure ownership, operational control, and strategic market expansion,” […]

- Channel Business Related TopicsLink to SolarWinds: Perception Gaps Found in Operational Resilience

SolarWinds: Perception Gaps Found in Operational Resilience

SolarWinds: Perception Gaps Found in Operational ResilienceSolarWinds report shows why IT leaders need to take action on processes and prioritize people improvements over new tools to address resilience gaps.

Link to Apono Launches New Global Partner Program Apono Launches New Global Partner Program

Apono Launches New Global Partner ProgramApono launches a global partner program to deliver scalable, identity-aware access controls with GTM support, training, and cloud ecosystem access.

Link to CGS Restructuring Into Four Independent Companies CGS Restructuring Into Four Independent Companies

CGS Restructuring Into Four Independent CompaniesCGS restructures into four independent companies to sharpen focus, drive growth, and better serve global markets across tech, learning, and CX.

Link to Video: Q2 2025 Channel Insights and Trends with the Channel Insider Editorial Team Video: Q2 2025 Channel Insights and Trends with the Channel Insider Editorial Team

Video: Q2 2025 Channel Insights and Trends with the Channel Insider Editorial TeamA fast-paced editorial recap of Q2 2025 in the IT channel covering leadership shakeups at Kaseya, layoffs at Intel, federal obstacles pausing major acquisitions, AI adoption slowdowns, quantum security threats, evolving partner programs, and global economic tensions.

Link to CloudBolt’s FinOps Now Available to Ingram Micro Partners CloudBolt’s FinOps Now Available to Ingram Micro Partners

CloudBolt’s FinOps Now Available to Ingram Micro PartnersCloudBolt partners with Ingram Micro, enabling MSPs and VARs to scale advanced cloud management and FinOps automation across environments.

Link to Infor Signs AWS Agreement, Brings GenAI to Marketplace Infor Signs AWS Agreement, Brings GenAI to Marketplace

Infor Signs AWS Agreement, Brings GenAI to MarketplaceInfor signs strategic AWS agreement to boost AI adoption, deepen cloud ERP capabilities, and accelerate global digital transformation.

- Security Link to Malwarebytes Launches New Email Security Module

Malwarebytes Launches New Email Security Module

Malwarebytes Launches New Email Security ModuleMalwarebytes adds AI-powered email protection to ThreatDown, unifying endpoint and email security for MSPs via IRONSCALES tech and Nebula console.

Link to Galactic Advisors on Addressing Vulnerabilities in the Channel Galactic Advisors on Addressing Vulnerabilities in the Channel

Galactic Advisors on Addressing Vulnerabilities in the ChannelGalactic Advisors uncovered critical flaws in Kaseya’s Network Detective; both firms moved fast to patch issues and highlight MSP risk assessment best practices.

Link to Cynomi’s State of the vCISO: MSPs & MSSPs Expanding Services Cynomi’s State of the vCISO: MSPs & MSSPs Expanding Services

Cynomi’s State of the vCISO: MSPs & MSSPs Expanding ServicesCynomi report shows vCISO demand tripled as MSPs turn to AI for scalable cybersecurity. 96% now offer or plan to offer vCISO in the next two years.

Link to MSPs More Popular Than Ever for Security: Barracuda MSPs More Popular Than Ever for Security: Barracuda

MSPs More Popular Than Ever for Security: BarracudaBarracuda study: Businesses rely on MSPs for security needs, with most willing to pay more for premium AI, integration, and 24/7 support.

Link to Scott Kuffer: CISA Cuts Show Need for Strategic MSP Offerings Scott Kuffer: CISA Cuts Show Need for Strategic MSP Offerings

Scott Kuffer: CISA Cuts Show Need for Strategic MSP OfferingsCISA funding cuts risk NVD stability — MSPs must adapt VM to better support customers and strengthen security resilience.

Link to SentinelOne & OPSWAT’s New OEM Partnership Drives Security SentinelOne & OPSWAT’s New OEM Partnership Drives Security

SentinelOne & OPSWAT’s New OEM Partnership Drives SecuritySentinelOne and OPSWAT partner to boost AI-powered malware detection for critical infrastructure protection on-prem and in the cloud.

- AI Related TopicsLink to The Top 50 AI Leaders in the Channel: 2025

The Top 50 AI Leaders in the Channel: 2025

The Top 50 AI Leaders in the Channel: 2025Channel Insider is thrilled to recognize the following leaders in vendor and solution provider businesses for their work in enabling the next generation of technology adoption. This list was compiled by Channel Insider’s editorial team to spotlight channel-focused leaders from MSPs, MSSPs, VARs, GSIs, vendors, and other channel businesses who are delivering measurable AI-driven outcomes […]

Link to Trend Micro and Google Cloud Double Down on AI Security Trend Micro and Google Cloud Double Down on AI Security

Trend Micro and Google Cloud Double Down on AI SecurityThe expanded alliance emphasizes AI-driven defenses, sovereign cloud capabilities, and new anti-scam protections for businesses worldwide.

Link to Arctera Updates Platform to Reduce AI Compliance Risks Arctera Updates Platform to Reduce AI Compliance Risks

Arctera Updates Platform to Reduce AI Compliance RisksArctera updates Insight to help organizations capture, chronicle & contain AI data, easing compliance and unlocking insights from LLM interactions.

Link to Video: How Port Is Redefining Developer Portals for the AI Era Video: How Port Is Redefining Developer Portals for the AI Era

Video: How Port Is Redefining Developer Portals for the AI EraDiscover how Port’s AI-native developer portal is helping engineering teams streamline workflows, reduce DevOps bottlenecks, and build scalable software faster.

Link to Nasuni Launches File IQ and Ops IQ for Smarter Data Ops, AI Nasuni Launches File IQ and Ops IQ for Smarter Data Ops, AI

Nasuni Launches File IQ and Ops IQ for Smarter Data Ops, AINew File IQ Premium and Ops IQ tools aim to help enterprises uncover file activity, system trends, and AI-ready insights across unstructured data

Link to LevelBlue & Kompingo to Bring Managed Security to UK MSPs LevelBlue & Kompingo to Bring Managed Security to UK MSPs

LevelBlue & Kompingo to Bring Managed Security to UK MSPsLevelBlue and Kompingo partner to deliver scalable managed security to UK MSPs and MSSPs, bridging the cyber skills gap with expert threat protection.

- Infrastructure Related TopicsLink to GTT Research Highlights Private Cloud Demand Resurgence

GTT Research Highlights Private Cloud Demand Resurgence

GTT Research Highlights Private Cloud Demand ResurgenceGTT survey shows rising private cloud demand driven by security, compliance, and AI needs, offering partners new opportunities to guide migration.

Link to Nerdio’s Will Omnisky on AVD & Windows 365 Opportunity Nerdio’s Will Omnisky on AVD & Windows 365 Opportunity

Nerdio’s Will Omnisky on AVD & Windows 365 OpportunityNerdio’s MSPs navigate device refreshes, tariffs, and virtualization, advising clients through uncertainty with Azure Virtual Desktop and Windows 365.

Link to DartPoints Secures $250M to Expand Data Center Reach DartPoints Secures $250M to Expand Data Center Reach

DartPoints Secures $250M to Expand Data Center ReachDartPoints, a provider of secure, high-performance data center solutions for enterprises, recently announced a significant investment from NOVA Infrastructure, a middle-market infrastructure investment firm, to scale DartPoints’ platform. Investment from NOVA and OIC pushes data center solutions forward “We’re entering a new phase of growth centered on infrastructure ownership, operational control, and strategic market expansion,” […]

-

- Lists & AwardsTop ArticlesLink to CML 100 Honorees

CML 100 HonoreesCheck out our CML 100 List to discover the top channel marketing individuals who are transforming channel marketing for their organizations.Link to HSP 250 List

CML 100 HonoreesCheck out our CML 100 List to discover the top channel marketing individuals who are transforming channel marketing for their organizations.Link to HSP 250 List HSP 250 ListView our HSP250 list to see the top Hybrid Solution Providers that have proactively embraced the future of tech.Link to The 2024 Channel Insider VIP List

HSP 250 ListView our HSP250 list to see the top Hybrid Solution Providers that have proactively embraced the future of tech.Link to The 2024 Channel Insider VIP List The 2024 Channel Insider VIP ListChannel Insider sought nominations from IT vendors, solution providers, and partners to highlight impactful collaborations. Check out our top choices here.

The 2024 Channel Insider VIP ListChannel Insider sought nominations from IT vendors, solution providers, and partners to highlight impactful collaborations. Check out our top choices here. - About